On April 9, Holy Cross College President Dr. Marco Clark revealed details of the College's “Campus Master Plan,” which has been developed over the past two years. The plan, which spans 20 years, will cost the school over $350 million and completely transform the campus.

Included in the plan, which is expected to be voted on and approved by the Holy Cross College Board of Trustees, are new classrooms, academic spaces and dormitories to help the school continue to grow enrollment.

When asked how it felt to have the plan completed, Clark expressed gratitude.

“It’s been a really gratifying process,” Clark said. “I would say that it was providential that the board allowed me to lead that initiative instead of having it done before I got here because it really gave me the opportunity to listen.”

The plan is undoubtedly one of the most ambitious undertaking in the young college’s 58-year history. According to Clark, the college has only raised $60 million, ever.

But instead of viewing it as one large $350 million project, Clark views it as a collection of projects.

“The old saying is, the question is, ‘How do you eat an elephant? One bite at a time.’ And I think we just tackle it one bite at a time,” he said.

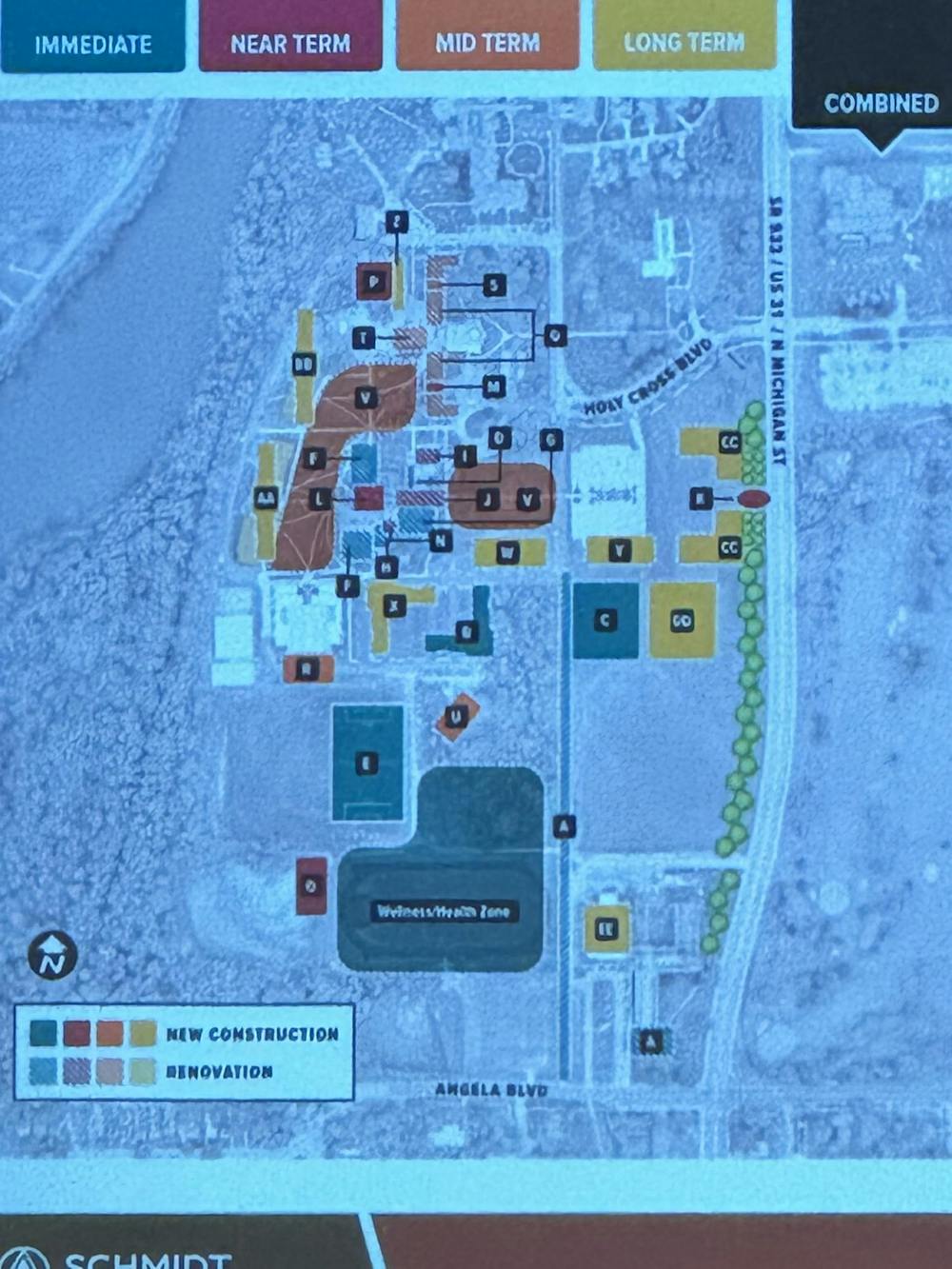

Helping that mindset is the plan's current format. The 20-year plan comprises four subsections: immediate (one to two Years), near-term (three to five years), mid-term (six to eight years) and long-term (nine to twenty years).

Earlier drafts of the Master Plan were too front-loaded, Clark said, requiring the school to raise $150 million to $200 million within the first five years. Clark felt that version of the plan was asking too much initially.

“We need to have some small victories in order to get the big ones. I wanted to identify those impactful projects that would cost less that could be done quick and really make a difference in the community,” he said.

The updated plan takes a much slower, steadier approach. The immediate phase will cost $31,985,000, while the near-term phase should cost $9,310,000.

The later phases see a significant jump in cost, with the mid-term costing $30,350,000. The long-term phase is expected to cost the most at just over $200 million.

The plan sets a priority order of events, though the order is not set in stone.

“It may be that somebody, some donor may come forward and say, ‘Hey listen, you know what, this fourteenth thing on the list is more important to me; I’ll help you with that.’ So it may be that that thing gets elevated,” Clark explained.

The immediate phase was designed to address the college's most pressing needs as quickly as possible and includes additional parking, an overhaul of the Driscoll Auditorium, a new “Student Success Center,” and more classrooms and labs.

But the most expensive piece of the phase is the construction of a new dormitory that will house 200 students. The dormitory is expected to cost over $25 million.

Once the plan is approved, the administration will turn its attention to figuring out how they can finance the dorm. Dr. Clark discussed the three main options.

The first would be contracting with a financial advisory deal to broker an agreement with a third party. The second would be reaching out directly to financers. The third pathway, which could happen in conjunction with the other two, would be a design-build-leaseback setup.

Part of the school’s decision-making process included not wanting to finance the new buildings by raising the cost of room and board dramatically.

“If you finance large projects like this, somebody pays for it. Usually, it gets added to tuition. We didn’t want to do that; we want to keep tuition mitigated as much as we possibly can,” Clark said.

The school’s goal is to raise 50% of the cost through fundraising and the other half through a loan. Thanks to the school’s growing endowment and lack of debt, Clark expressed optimism about the prospect of external financing.

“The financial viability and sustainability of the college has been so strengthened to where now banks and lenders and other financial industries have become more confident, and they have seen the growth, and they see the plan,” Clark noted.

In 2017, the school went through a period of financial struggles as the school accumulated debt to expand its facilities.

Clark highlighted the differences he sees between the state of the college now and the state of the college back in 2017.

“In 2017 ... there had already been a financial crisis for many years. There was a carry-over from many, many years of debt and shortfalls in enrollment and decision-making that led to where we were in 2017.” Clark stressed. “The work that’s been done, even prior to my arrival here to prepare for the future of Holy Cross, is just much stronger than it was in 2017.”

Clark admitted there are some risks in pursuing this plan.

“This is a generational decision,” he said. ”What we’re about to decide on in taking some financing in assuming some risk, some debt that the college hasn’t had, it is generational in the sense that it could impact future generations; it could limit future decisions.”

Ultimately, however, Clark said he trusts the staff of the college.

“I do think that we’ve got the team to be able to help take Holy Cross to the next level. God has just been so good to us, frankly. When I look around at my colleagues ... it’s a really good strong team of people to help bring the College to the next level,” Clark explained.

The full Campus Master Plan will be released later this year once it has been approved by the Holy Cross College Board of Trustees.