On Tuesday afternoon, the Keough School of Global Affairs hosted a lecture titled, “Managing Debt and Development: How China’s Financial Statecraft Works in Latin America” with roughly 40 in attendance.

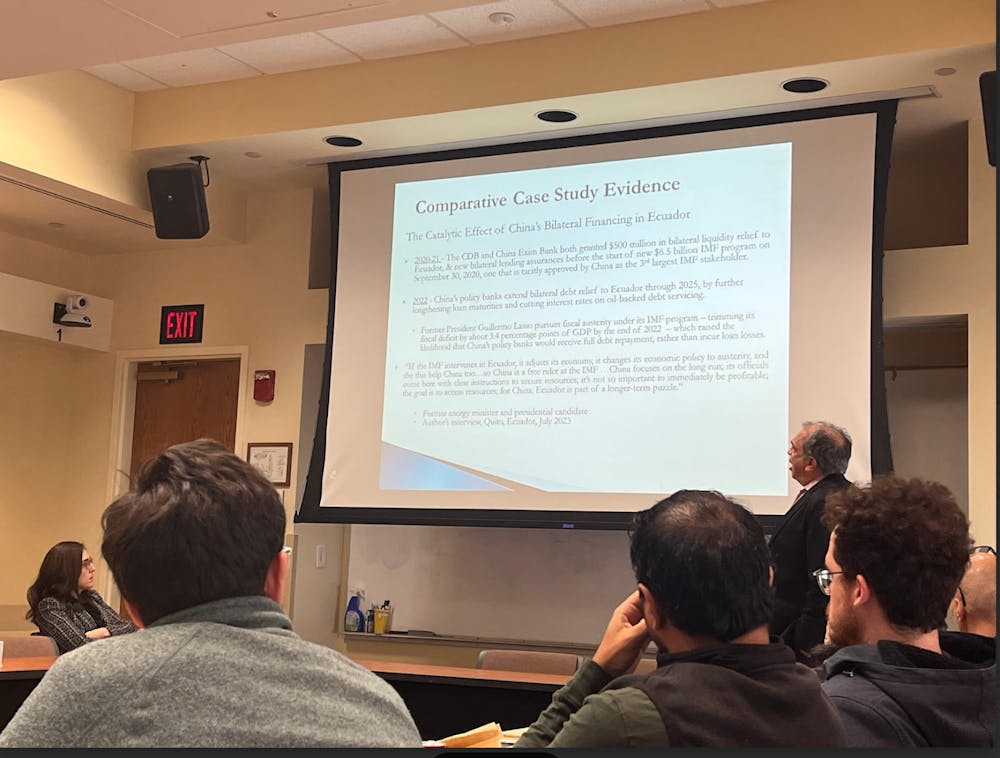

The presentation was provided by Stephen Kaplan, an associate professor of political science and international affairs at George Washington University. The lecture focuses on China’s financial ties with countries in Latin America that are economically at risk.

The discussion closely paralleled the ideas in his book, “Globalizing Patient Capital: The Political Economy of Chinese Finance in the Americas,” which provides an in-depth analysis on the sudden burst in Chinese lending to Latin American governments.

Kaplan began the lecture by explaining the origins of China’s rapid rise as one of the world’s top creditors, attributing the development to the 2008 financial crisis, in which many western lenders withdrew from the financial market while China firmly exerted its financial influence.

“While Western capital was retreating, China saw an opportunity to expand its financial footprint,” Kaplan said.

Through large amounts of lending from policy banks such as the China Development Bank and the Export-Import Bank of China, the Chinese government began rapidly financing infrastructure, energy and industrial projects all over the world, specifically in Latin America.

The loans, however, differed remarkably from those in Western countries. Unlike the United States or the International Monetary Fund, China tends to avoid imposing strict policy conditions, such as economic reforms that often come with Western loans.

Kaplan pointed out that China takes a different route, pursuing its loans through a process called commercial conditionality. When China provides loans, it typically expects the borrower to work with Chinese companies, use its machinery or implement its technology in the projects that are funded.

“It’s less about forcing policy change and more about creating commercial opportunities for Chinese firms,” Kaplan said.

The lecture also explored the broader geopolitical implications of China’s financial ties with Latin America and how that may affect future global cooperation. China’s expanding role in global finance significantly raises its global influence, particularly as it encourages the use of its currency in other countries.

For example, Argentina uses Chinese renminbi instead of U.S. dollars to pay off a portion of its IMF debt. This was a significant development that highlighted the effects of China’s growing influence in this sector.

Kaplan’s research speaks to a complex reality. Although China’s loans may not reflect the same strict measures compared to those in Western countries, it nevertheless has strategic goals in mind. This includes supporting Chinese industries and ensuring China’s rise on the global stage. For countries in Latin America, China’s financial ties offer opportunities and uncertainties in the region.

The lecture concluded with Kaplan pointing out Latin American governments are forced to navigate a difficult reality, as they attempt to balance their growing financial ties with China with their relationship to many Western countries, including the United States.

“Rather than being a source of competition, it’s a way for China to play a two level game,” he said. “It’s still extending bilateral loans oriented towards expanding strategic and commercial Space internationally, but then the ability to use IMF as a financial backstop and often timing bilateral loans to be able to do that.”